Cities Don’t Have to Approve Big Tax Hikes

For years, media have documented all kinds of wasteful, inefficient and scandalous activities involving large cities in Canada.

Yet when budget time comes around, many of those same cities pass large property tax hikes. What’s worse, many among the chattering classes then repeat claims by their respective city councils that the city “had no choice” but to pass those large tax hikes.

Canadians should know that’s nonsense.

In the vast majority of cases, large property tax hikes aren’t necessary. The truth is, city governments (like other levels of government) generally aren’t known for spending tax dollars wisely. If they were more careful with our tax dollars then large tax hikes could become small tax hikes or perhaps a tax freeze or cut.

I’ll use Calgary as an example and look at Naheed Nenshi’s time as mayor to illustrate this point.

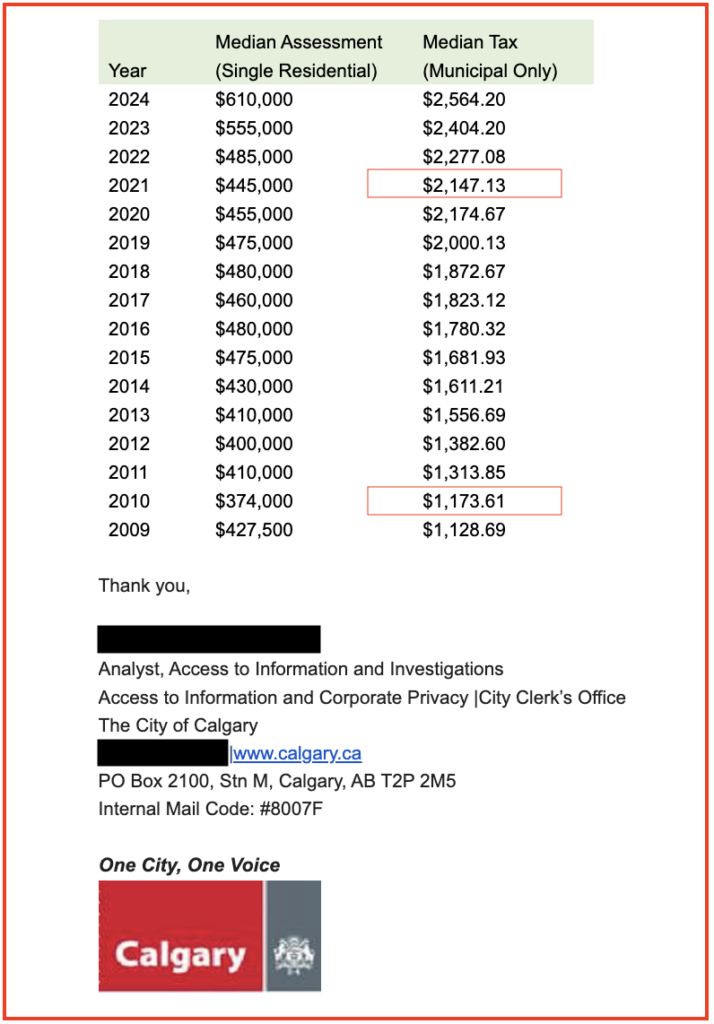

The table below was provided to SecondStreet.org by the City of Calgary in response to our Freedom of Information request on how much the typical detached house in Calgary pays in property taxes to city hall. (City Hall only posts data going back to 2016 online so we had to file a Freedom of Information request to get the remainder)

Median Property Taxes for a Detached House in Calgary

As you can see, when Mayor Nenshi was elected in October 2010, the median detached house was only paying $1,173.61 in municipal property taxes. By the time he left in October 2021, the property tax bill for the median detached home was $2,147.13. That means that during Nenshi’s term as mayor, the typical house in Calgary saw their property taxes go up by 83%.

Over the same period, average weekly earnings in Alberta rose from $1,010 in October 2010 to $1,230 in October 2021 – a 22% increase.

If your pay cheque only went up by 22% and your property tax bill went up by 83% that’s obviously not a good situation. Think about your household budget as a pie chart with the slice of the pie marked as “property taxes” growing over time. That means you have fewer dollars to pay for slices of the pie that are important to you – going out for dinner, putting your kids in hockey, etc.

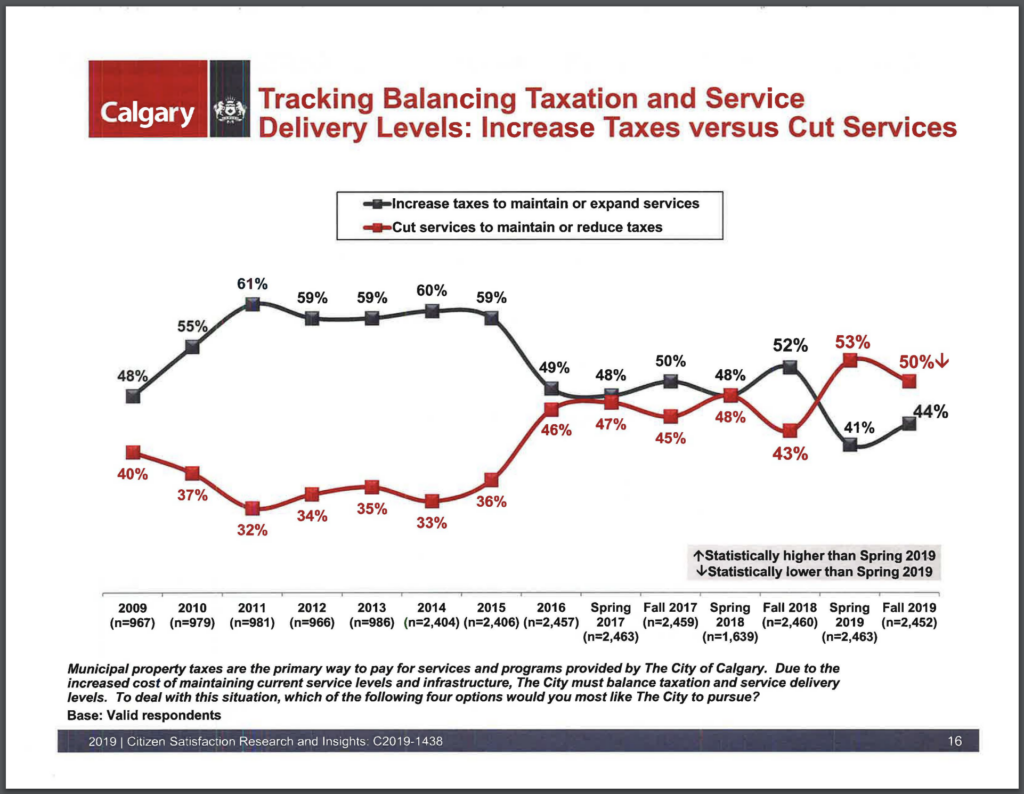

During this same period, Calgary’s city hall would routinely present the notion that unless it raised taxes, citizens would face service cuts. Here’s the city’s 2019 citizen satisfaction survey that presents this false choice:

Now ask yourself this:

* If the city hired a private company to pick-up homeowners’ garbage – instead of paying city staff to do it – and the city saved money, is that a service cut? No.

* If Calgary’s city council had a less expensive pension, similar to Edmonton’s council, would that be a service cut? No.

* What if the 1,936 employees at the City of Calgary who are set to receive two or three pensions when they retire instead “got by” with just one? Would that be a “service cut”? No.

As the examples above show, there are many ways that cities can reduce costs without reducing the services provided to the public. From partnering with the private sector to deliver city services to selling off unused land and restraining wages and benefits at city hall, there is much room for improvement at city halls across Canada.

What the public needs are council members who are willing to look under every stone for savings and make difficult decisions rather than taking the easy way out. In Calgary’s case, the city was spending $8 million on bonuses for city staff each year that council didn’t even know about. The bonuses were written up each year in the city’s financial statements each year … but council apparently hadn’t bothered to read such materials.

While private sector employees in Canada often face layoffs and wage reductions when difficult times emerge, research by SecondStreet.org in 2020 found that it has been decades since unionized government employees in Canada received a pay cut. It has always been just easier for city hall to raise taxes than expect its employees to feel the same pinch that everyone else feels when times are tough.

In 2021, Franco Terrazzano from the Canadian Taxpayers Federation and I co-authored a policy brief that outlines 10 different ways that city governments could reduce their costs. City politicians could review – and act on – those 10 items carefully instead of reaching deeper into your pocket.

You might just want to review them too for the next time a politician asks you for your thoughts about taxes at city hall.

Colin Craig

President – SecondStreet.org

You can help us continue to research and tell stories about this issue by making a donation or sharing this content with your friends. Be sure to sign up for our updates too!