Another look at Winnipeg’s city council pension

Winnipeg’s city council made headlines during the previous term for attempting to reform the pension plan for the Winnipeg Police Service.

Council argued the police pension plan was simply too costly for taxpayers.

But put aside the police pension plan for a moment and consider this question – what does council’s pension plan cost taxpayers?

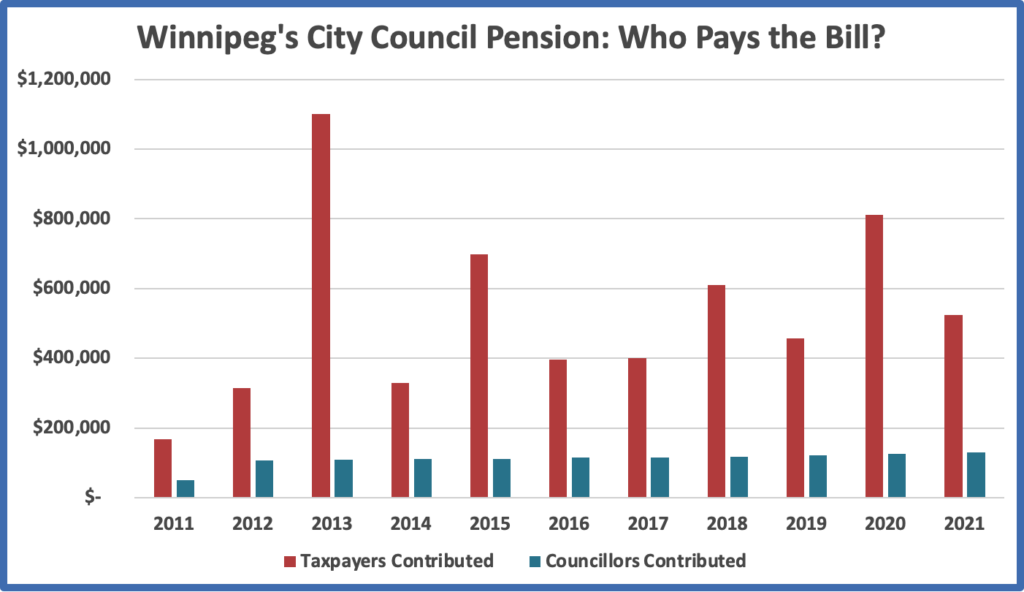

From 2011 to 2021, here is what the bill looks like:

Taxpayers paid: $5.8 million

Council paid: $1.2 million

That means for every $1.00 city council members contributed towards their pension, taxpayers put in almost $5.00. (To see all the sources for this calculation – click here),

Council will likely have all kinds of reasons for why their plan costs so much, but readers should note that it doesn’t have to be this way.

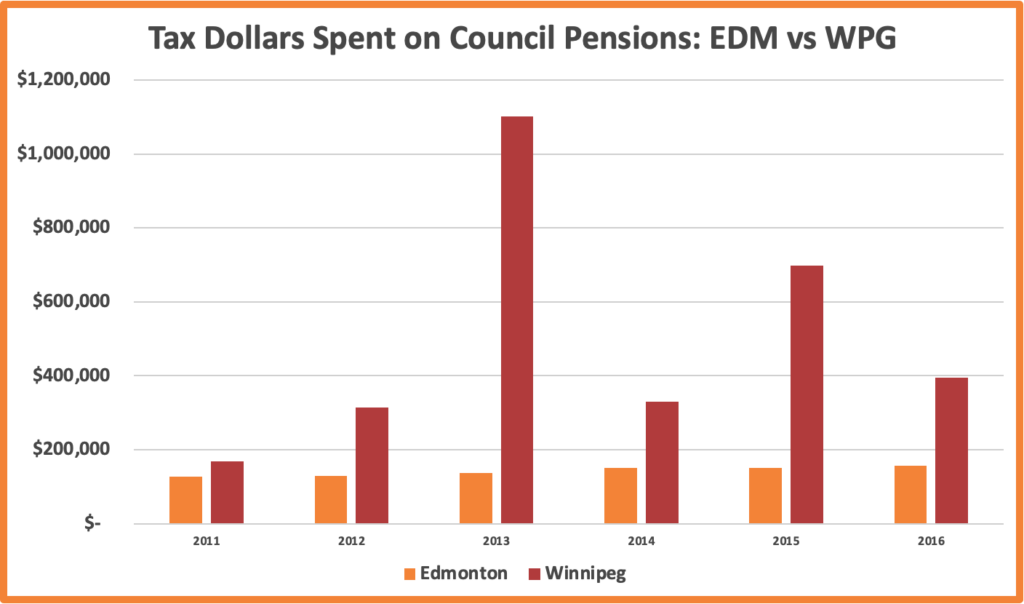

Look at how much taxpayers paid for Edmonton’s council pension plan between 2007 and 2016 versus how much taxpayers had to pay for Winnipeg’s council pension plan.

(Note: I don’t have more recent figures for Edmonton but we would see a similar pattern for 2017-2021 as the two cities offer very different retirement benefits)

Why is Edmonton’s bill relatively flat over time?

Simply put, their city gives council members retirement benefits that are more in-line with the public rather than the expensive type of pensions that politicians often choose for themselves.

Winnipeg could also get its council pension costs under control … unless of course, council would rather focus on the police pension plan.

You can help us continue to research and tell stories about this issue by making a donation or sharing this content with your friends. Be sure to sign up for our updates too!